The Lights Are Still On, But Nobody’s Shopping

How the consumer cracked while the stock market partied

A Black Friday scene, November 2025

It’s 6:47 p.m. on the biggest shopping night of the year, and the Target parking lot in suburban Dallas is half empty. Inside, the holiday playlist loops Mariah Carey for the third time in an hour, but the aisles feel like a museum after closing. Red-shirted employees outnumber customers three to one. A lone dad pushes a cart with two toys and a 48-roll pack of store-brand toilet paper — the only way he can justify the trip to his wife back home. At self-checkout, the machine scolds him: “Unexpected item in bagging area.” He removes the toilet paper, scans it again, and mutters, “Yeah, tell me about it.”

Ten miles away, a Walmart supercenter is mobbed. Same night, same city, two different economies.

This is not a tale of two retailers. This is the American economy splitting in two right in front of our eyes — and only one half is being televised.

The Thesis Nobody Wants to Hear

Wall Street is at all-time highs, Nvidia just printed another $30 billion quarter, and the official unemployment rate is still “low.”

Yet underneath the headline numbers, the real economy is quietly contracting. Jobs aren’t being created — they’re evaporating. Consumers aren’t spending — they’re surviving. Factories aren’t ramping — they’re stuffing warehouses with goods nobody wants. And the shadow banking system that greased the boom is now discovering its collateral is worth zero.

The data is no longer whispering. It’s screaming.

Planned holiday gift spending now $778 per household, down $229 (~20%) from October’s $1,007, and far below last year’s $1,002. Largest mid-season drop Gallup has ever recorded, exceeding the $185 plunge during the middle of the 2008 crisis.

1. The Labor Market Has Entered the Flat Beveridge Curve

For years we heard “no hiring, no firing.” In 2025 that became “no hiring, some firing.”

In November, the Chicago ISM survey asked hundreds of purchasing managers a simple question: Did you increase employment last month?

Answer: zero. Not one single respondent. The last time that happened was May 2009.

Nationally, the ISM manufacturing employment index sits at 44 — for every company talking about hiring, 3.4 are talking about layoffs. Verizon, Amazon, UPS, even the U.S. Postal Service — all announcing cuts or slashing seasonal hiring right before Christmas. When the Post Office hires only 14,000 holiday workers instead of the usual 40,000, you know demand has collapsed.

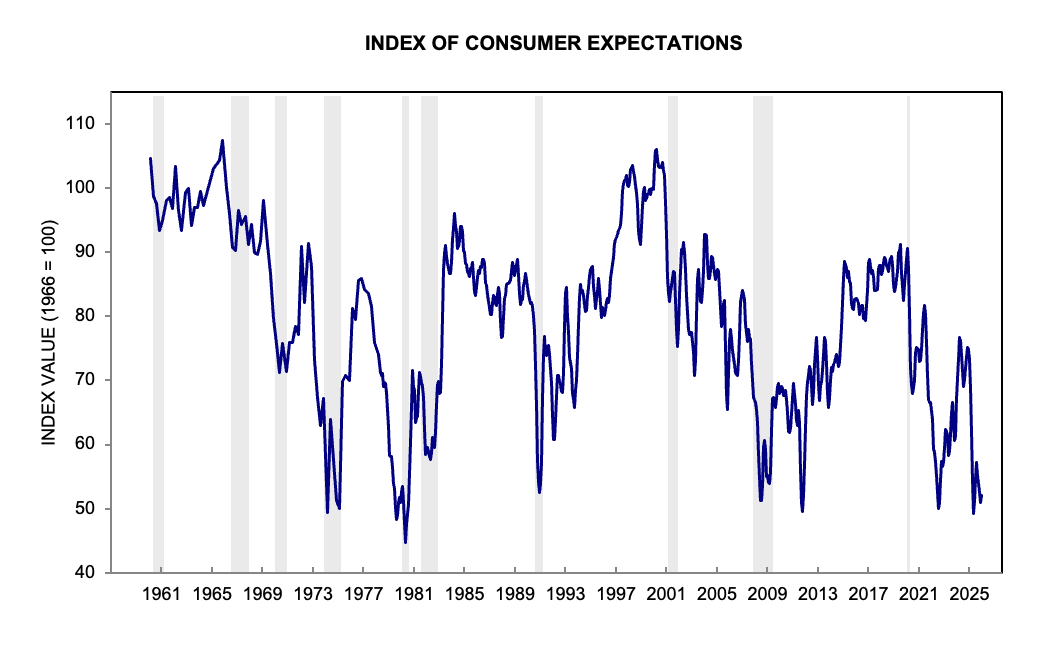

Consumers feel it first. University of Michigan’s November survey showed 71 % of Americans expect unemployment to rise over the next year — the second-highest reading in fifty years of data. Only May 1980, at the dawn of the Volcker recession, was worse.

2. The Consumer Is Out of Runway

Black Friday looked decent — until you saw the fine print.

Nominal retail sales rose 3–9 %. Volume fell 1–2 %. Units per transaction dropped 2 %. Americans paid more to buy less, then went home and skipped the groceries so the kids could have Christmas.

Procter & Gamble, maker of Tide and Pampers, told analysts that even middle-class households are trading down to smaller pack sizes on necessities. Target raised prices ~2 % and watched same-store sales fall 3%.

Translation: the consumer has reached the pain threshold.

Meanwhile, dollar stores and Walmart thrive because the bottom 60% of the income distribution is now does the majority of its shopping at places that sell 89-cent cans of beans.

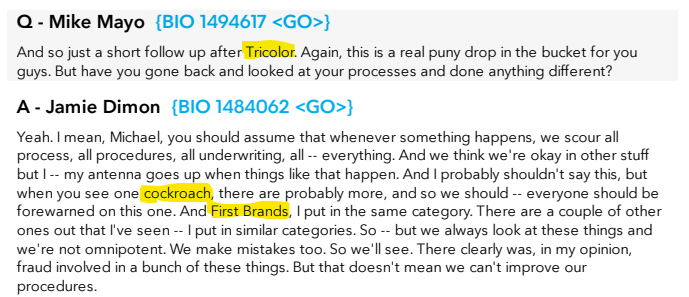

3. Shadow Banking Cockroaches Are Coming into the Light

Remember when private credit was going to be the safe, boring, covenanted replacement for junk bonds?

Renovo Home Partners — a roll-up of kitchen and bathroom remodelers created at the 2022 peak — just filed for bankruptcy. BlackRock, Apollo, and Oaktree had their loans marked at 100 cents on the dollar in September. By November they were marked zero. 100→0 in weeks.

First Brands, another private-credit darling, blew up and is forcing “high-grade” funds to face 30 % losses. Investors — including Singapore’s sovereign wealth fund — are demanding their money back from Jefferies-owned hedge funds. Redemptions are spreading.

Even Jamie Dimon is seeing the cockroaches on the ground!

These aren’t isolated incidents. They are the cockroaches you see when someone finally turns on the kitchen light. The real question is how many more are still in the walls.

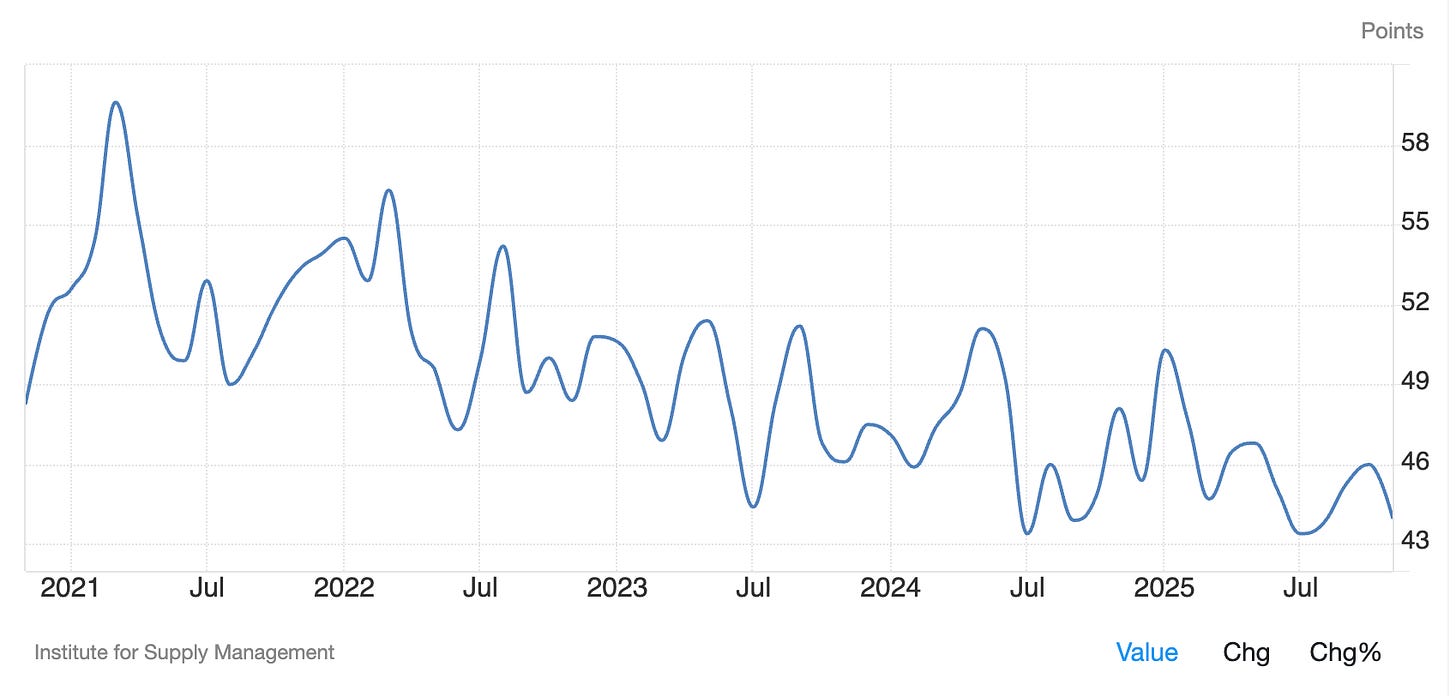

4. Manufacturing Is Building Inventory for a Recovery That Isn’t Coming

S&P Global’s November report contained a sentence that should have stopped every trader in their tracks:

“The buildup of unsold stocks was unplanned and to a degree not previously seen since comparable data began in 2007.”

Factories kept producing all summer betting on a second-half rebound that never materialized. Now warehouses are stuffed, backlogs are collapsing (Chicago backlogs at 2009 lows), and the next move is obvious: production cuts and layoffs.

5. Housing Has Quietly Rolled Over

Mortgage rates have been falling for two years and purchase applications are still near 30-year lows. Why? Because 90% of homeowners are locked into sub-4% mortgages and won’t sell, and the other 10% can’t afford today’s prices with 7% rates.

Result: transaction volume has collapsed, builders are sitting on record finished inventory, and Zillow now expects the average U.S. home to fall 9.7 % from peak.

Commercial real estate is even uglier — office vacancy in major cities is pushing 25%, and regional banks are praying the FDIC doesn’t make them mark to market.

6. The Dollar Is Telling the Real Story

While CNBC blames a possible skipped December rate cut for Bitcoin’s 33 % crash, the U.S. dollar index is busy ripping to new highs. The Canadian dollar, Kiwi, Korean won, and Indian rupee are all back to their April 2025 lows — the exact pattern we saw in every global growth scare since 2008.

Rising dollar = global liquidity tightening = risk-off. Always has. Always will.

Back to the Half-Empty Target

That dad with the toilet paper and the two toys finally makes it through self-checkout. As he walks out past the flickering holiday displays, he passes a giant cardboard cutout of Federal Reserve Chairman Powell smiling under the words “Soft Landing Achieved.”

He doesn’t smile back.

Because he knows what the data is only now admitting: the landing isn’t soft. The plane is already in the tanker territory — engines sputtering, altitude bleeding, and the cockpit crew still arguing about whether to put the gear down.

The lights are still on in the cabin.

But half the passengers have already stopped buying drinks.

The cockpit can keep smiling.

The altimeter doesn’t lie.

We borrowed three years of demand from the future with printed money and shadow leverage.

2025 is the future showing up with an overdue invoice — and the collateral we posted turns out to be worth zero.

That’s the payback.

And it’s only just getting started.

I am a small business that makes and sells candles, melts, room sprays and car air fresheners and I see it every show and it freaks me out. My sales are way down. I see a lot of browsing and little buying. I wish folks would stop buying at big box stores and buy from us little guys.

One contrast: Target went woke, very publicly. Walmart corporate tried to mind the store, and maintained a low culture conflict profile the last few years. Both companies are often sell similar/identical products.

My family members now refuse to shop at Target. I don’t believe my family is an isolated data point.