The Great Hiring Freeze: Anatomy of a Fake Boom and Real Bust

You’re not imagining it—things feel off in the economy. It’s not one obvious explosion. It’s a series of cracks forming beneath the surface: hiring freezes, student loan delinquencies, tanking oil consumption, and hedge funds running for cover.

But what if the core problem isn’t layoffs? What if the deeper truth is that businesses simply… stopped hiring?

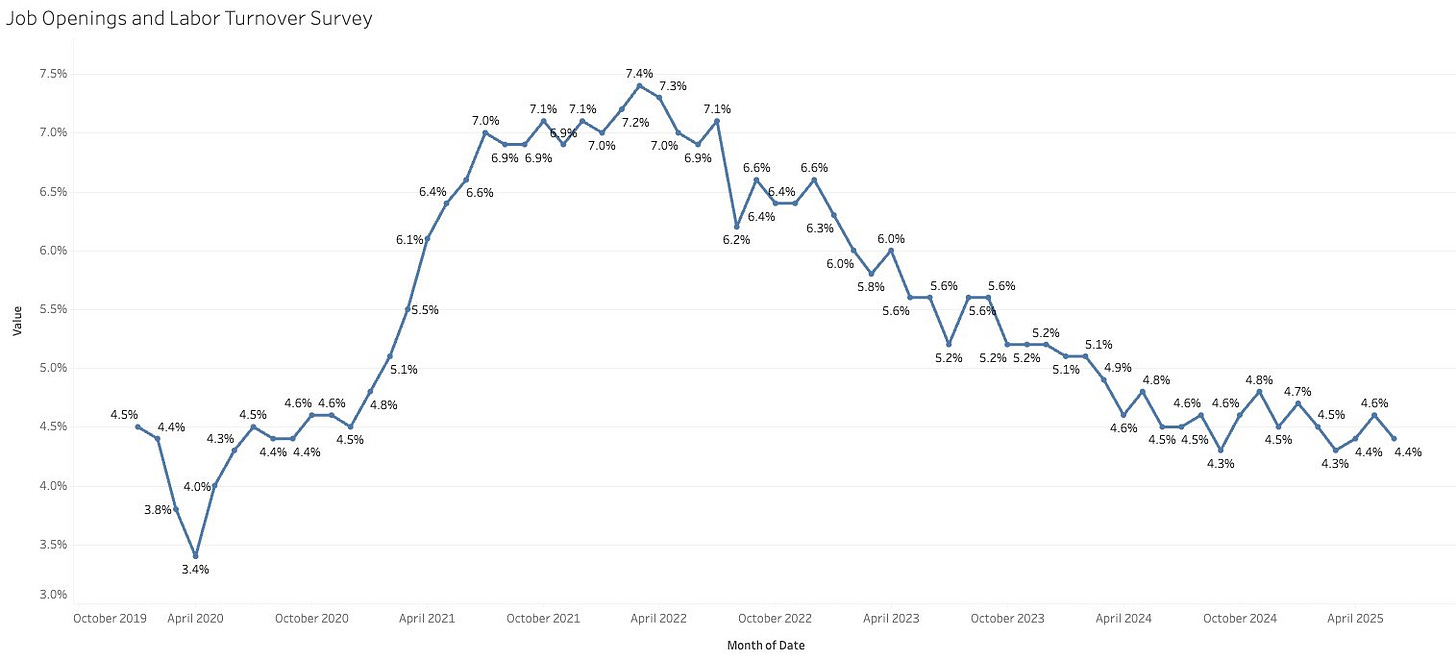

Let’s start with this chart 👇

What JOLTS Just Told Us

The Job Openings and Labor Turnover Survey (JOLTS) is now at its lowest point since September 2020. That was the thick of the pandemic. Today, we’re supposedly in a “solid” economy—so why are job openings vanishing?

The answer starts with a misread in 2021.

The COVID Stimulus Mirage

Flush with trillions in stimulus checks, tax credits, and bailouts, consumers went on a sugar high. Retailers and service providers saw demand spike and assumed it was permanent. So they hired. They overbuilt. They overstocked. They believed the hype.

But all of it—every dollar of it—was artificial.

The government printed fake demand. And companies misread the signal.

When the checks stopped, reality returned.

Crashing Back to Earth

With demand collapsing and inventories bloated, the overhiring now looks reckless. Instead of a layoff apocalypse, we’re seeing a different kind of correction: one where companies simply stop replacing staff, freeze growth, and quietly retract.

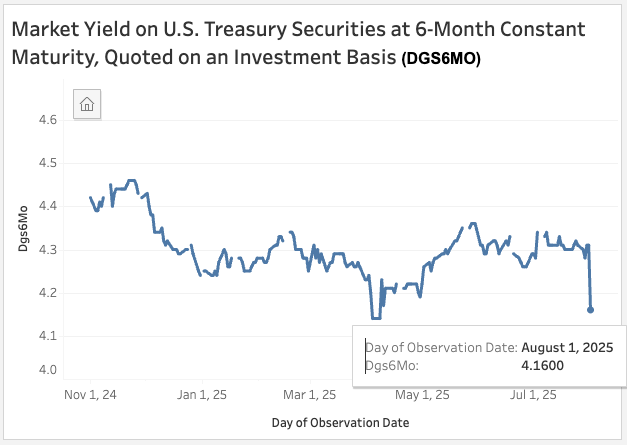

Bond markets are screaming it too. A sudden drop in the 6-month Treasury yield last Friday sent a chill through Wall Street. That’s not a vote of confidence. It’s a flight to safety.

Delinquencies Are Soaring

Consumers, especially those 50 and older, are getting squeezed hard.

Credit card and student loan delinquencies are rising—fast. The Fed may call this a “resilient” economy. The data says otherwise.

The 90+ day delinquency rate for student loans and credit cards is now touching levels we haven’t seen since the last financial crisis (or early COVID for student debt). This isn’t some blip. It’s a stress fracture in the consumer foundation.

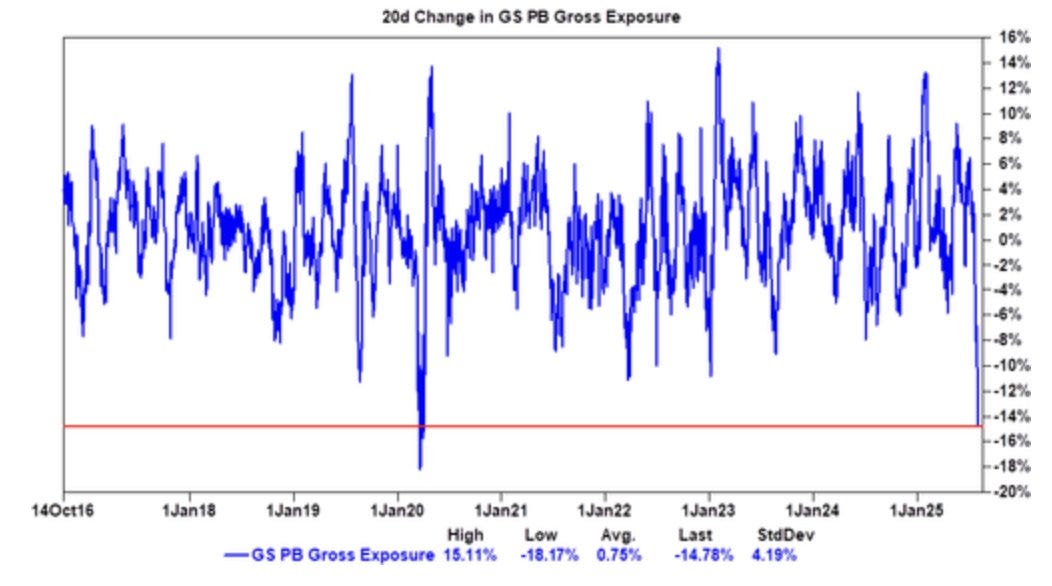

Hedge Funds Just Flinched

Hedge funds are reducing exposure at the fastest pace in 5+ years. That means they’re de-risking. Fast.

Just like in Margin Call, when the firm offloads toxic assets to avoid a total wipeout, today’s big players are scrambling to get ahead of what’s coming. They’ve seen this movie before.

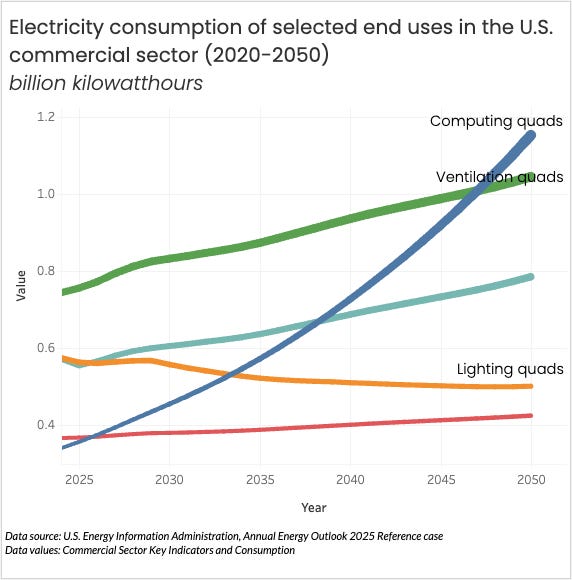

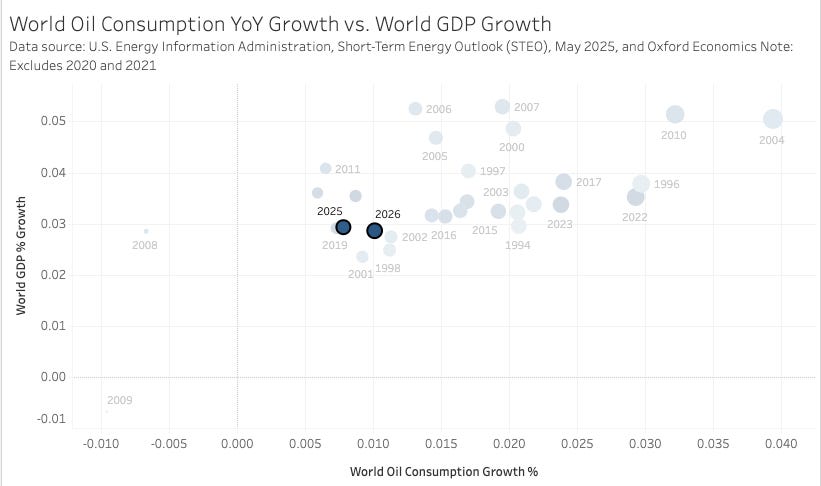

The Oil Canary in the Coal Mine

Still not convinced? Look at oil.

When oil consumption drops, economic activity slows. That’s how closely tied oil is to GDP growth. And 2025–2026 are now forecast to be some of the lowest oil growth years in decades.

We’re not just easing off the gas. We’re stalling.

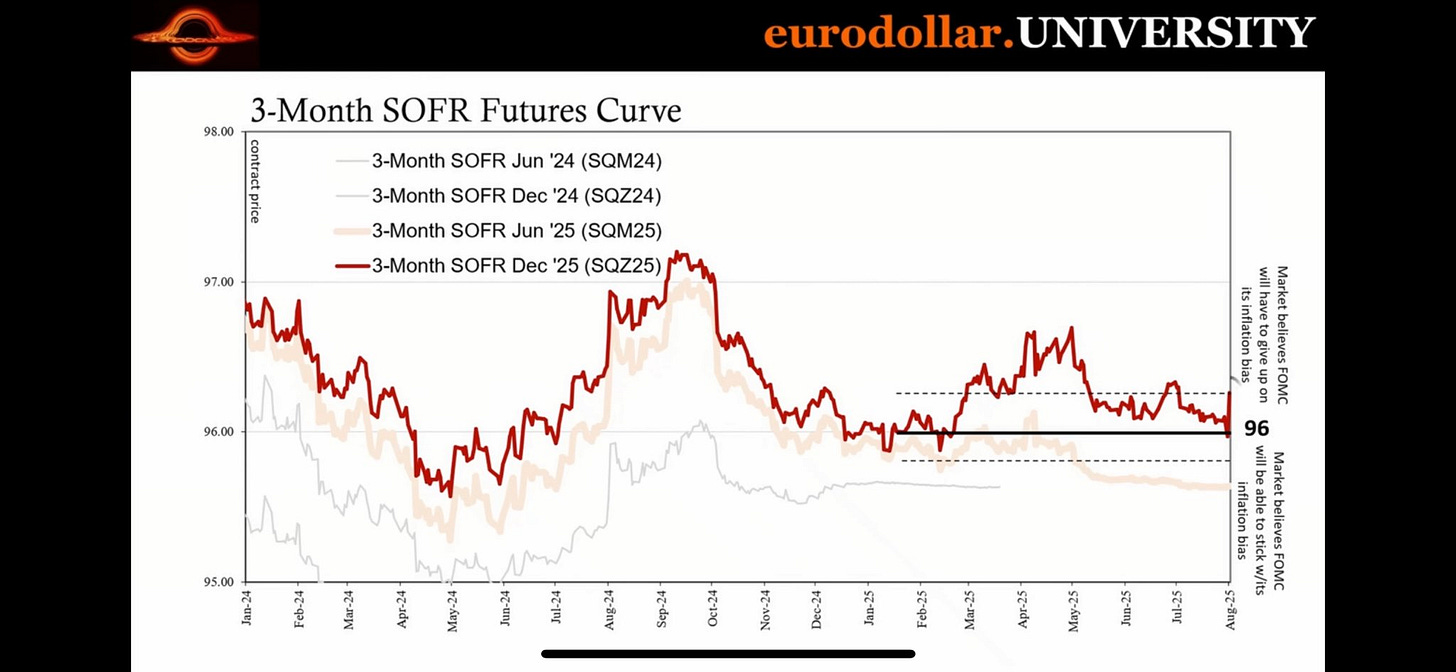

SOFR Futures Are Flashing Red

Another overlooked indicator? The SOFR futures market. Traders are betting big on rate cuts—aggressive ones. That only happens when they expect serious trouble ahead.

In just one day, we saw a 30 basis point move. That's not normal. That’s panic under the surface.

The Real Story: From Sugar Rush to Withdrawal

The labor market isn’t weak because of firings. It’s weak because companies are correcting from a misread of a temporary boom. They overhired during a hallucinated surge and now they’re pausing to catch their breath.

There’s no easy way out of a fiscal sugar crash.

If this economy were a patient, it would be:

Stimulant overdose in 2021

False high in 2022

Withdrawal symptoms in 2023

Cognitive dissonance in 2024

And 2025? Reality check.

This isn’t just a slowdown. It’s a reckoning.

We're witnessing the long tail consequences of policies that misunderstood the difference between short-term relief and long-term distortion.

This is cheerful. Thanks

Perhaps why Trump is trying to develop economic growth using every trick he can. The stalled growth of the last years are showing up now. Perhaps we are on a tightrope and could easily fall off if his measures fail. At issue is time for improvements to happen.

Tis so odd that his advisors aren’t talking the plan up in media. But nobody is happy with your message even because it’s true. The public remains unaware quibbling about genes/jeans. Distraction.