Silver's 40% Crash Was the Most Predictable Disaster of 2026

The precious metals frenzy that wasn't about the dollar at all — and the Chinese fraud story that proves it

Let’s do a quick check-in on the economy. This matters.

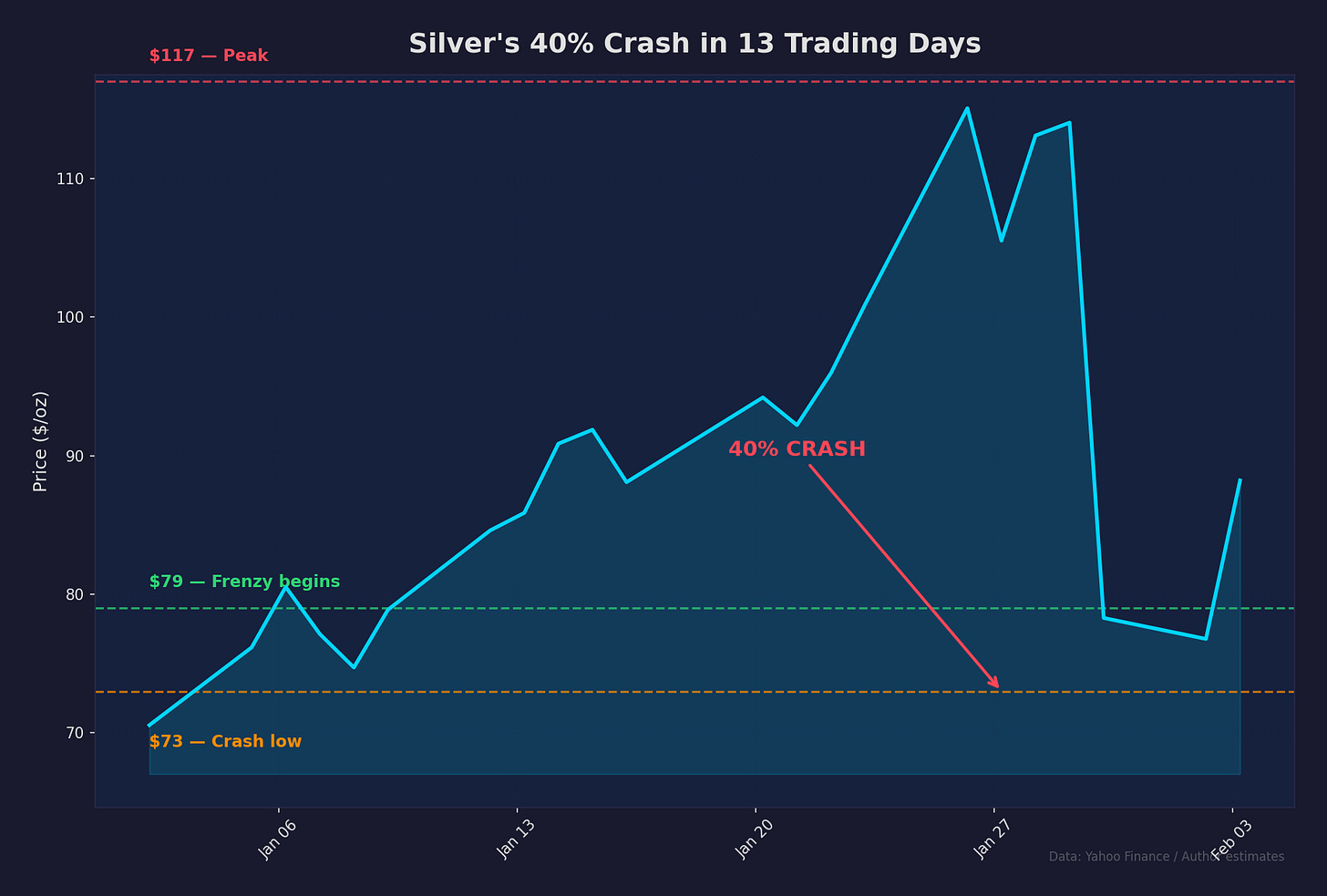

On Wednesday, silver hit $117 an ounce. By Friday, it was $73.

That’s not a correction. That’s a 40% single-day crash — the kind of move that wipes out leveraged accounts, liquidates retail portfolios, and sends financial Twitter into full existential meltdown mode. Some late buyers showed up near the close, limiting the official damage to “only” 26%. Cold comfort.

And then came Monday.

Stories out of China. A metals dealer they’re calling “The Hat” — fled the country, left behind $144 million in unfinished deals, and triggered a chain reaction of counterparty losses that reached all the way up to state-backed trading firms. Separately, hundreds of customers stormed a bullion platform in Shenzhen — some carrying their children — demanding either their money or their gold. The company couldn’t produce either.

Silver dropped another 7%. Gold fell below $4,700 — down 14% from last week’s record. And the story is still unfolding.

Here’s what nobody screaming “dollar debasement” wanted to hear: none of this was about the dollar.

Not the rally. Not the crash. Not the fundamentals underneath either one.

Treasury yields have been steady for months. If the dollar were truly being debased — if inflation were genuinely reigniting — you’d see it in the bond market first. You didn’t. What you saw instead was a supply squeeze in silver that went parabolic for the oldest reason in financial markets: price action became the story, and the story became the only reason to buy.

Silver went from $79 to $117 in thirteen trading sessions. Thirteen. That’s not a market. That’s a meme stock. And as Mike Green put it in a recent interview, that’s effectively what silver became — momentum chasing dressed up in hard-money rhetoric.

The “dollar is dying” crowd had one data point: precious metals going up. That was it. One market, one interpretation, one narrative — and an army of retail speculators pouring money into something they fundamentally misunderstood.

The China Problem

The fraud stories aren’t surprising. They’re inevitable.

When any commodity enters a speculative frenzy — especially one where physical supply is genuinely tight — dealers overextend. They take in customer money for metal they don’t have. They promise delivery from wholesalers who promise delivery from other wholesalers who are all, collectively, short physical metal.

It works beautifully on the way up.

Then the tide turns. Customers want their metal or their money. The dealer has neither — the money went to pay for metal that “no one can seem to locate.” That’s a direct quote from the Bloomberg reporting on the Shenzhen situation.

The Hat story is potentially worse. A trading network facilitating deals across multiple counterparties, including SDIC Commodities — a state-backed firm. Everyone in the chain owed money for metal shipments. The Hat disappeared. The chain broke.

This isn’t a black swan. This is what always happens when markets go straight up. The escalator up, the elevator down — and on the way down, you find out who was swimming naked.

Where Does Silver Actually Bottom?

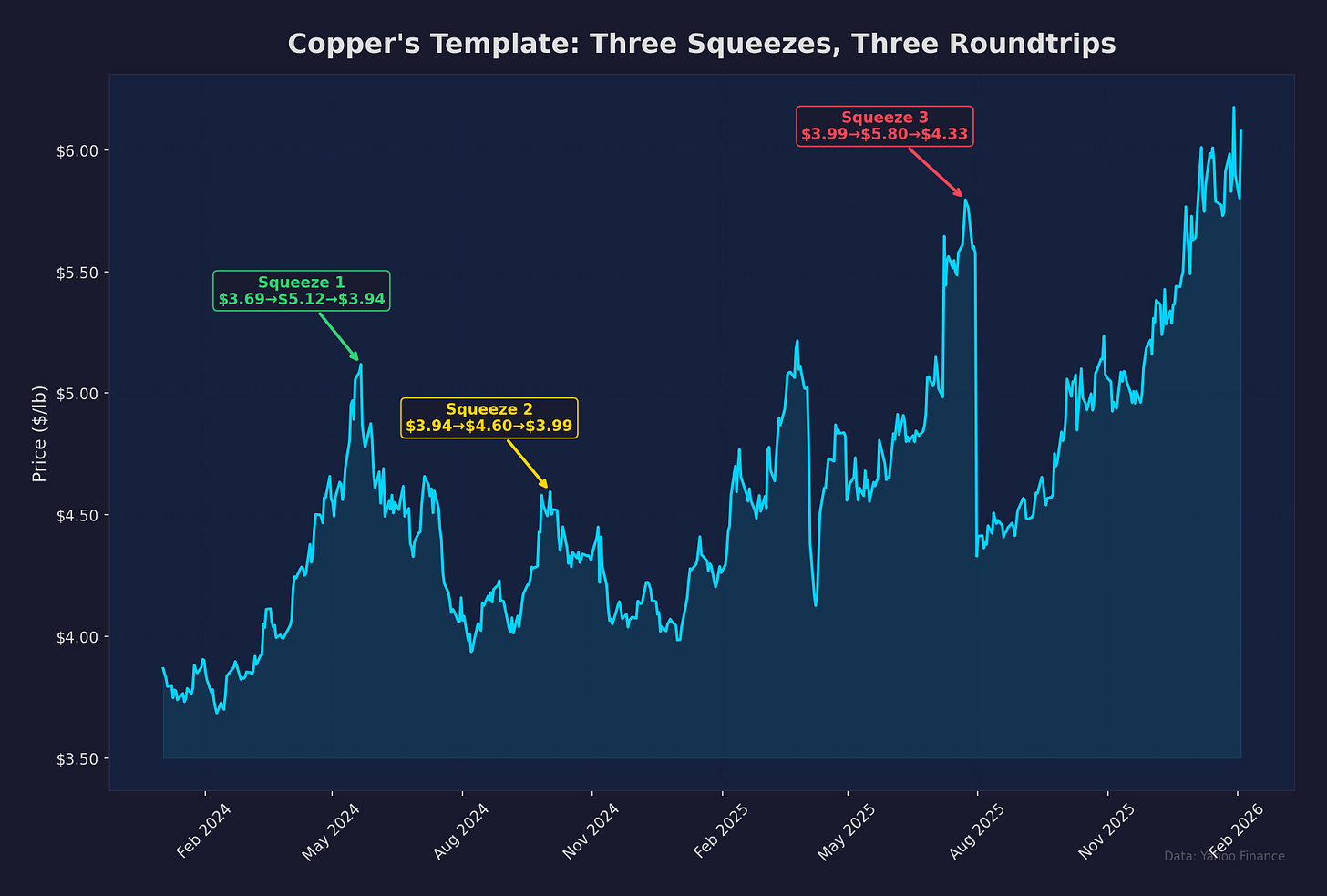

Three recent copper squeezes give us a template.

Squeeze #1 (Early 2024): Copper went from $3.70 to $5.11 on China panic buying. Reversed almost completely to below $4.00 by August.

Squeeze #2 (Late 2024): Trump tariff fears pushed copper from below $4.00 to $5.20. Deflationary liquidation dropped it back to $4.10.

Squeeze #3 (Mid 2025): More tariff fears. Copper hit $5.80. Then the administration hinted tariffs might not happen. Back under $4.30.

The pattern: near-complete roundtrips, every time. The speculative premium gets fully unwound.

Apply that to silver. The real chaotic buying — the speculative frenzy phase — started around $50 an ounce. That’s your gravity line.

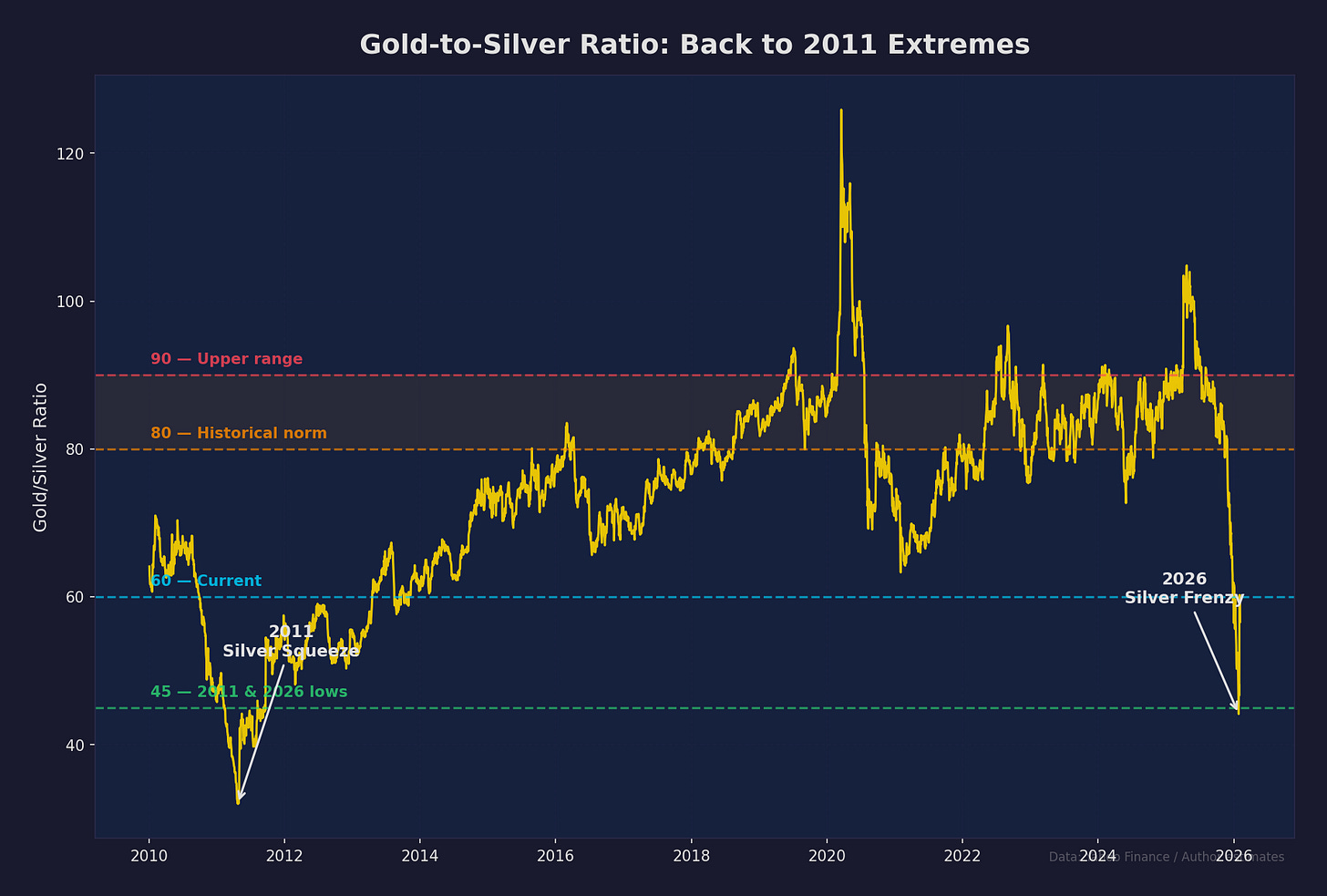

The gold-to-silver ratio confirms it. Before Friday’s crash, the ratio hit 45 — the lowest since 2011, which was the last time we saw a silver squeeze of this magnitude. (That one didn’t end well either.) The ratio has bounced back to about 60, but through the late 2010s and early 2020s, it consistently sat between 80 and 90.

A ratio of 80 puts silver at $58. A ratio of 90 puts it at $52. And if gold itself continues falling — currently $4,700 and dropping — those targets slide even lower.

Below $50 is not out of the question.

The Real Story: Deflation, Not Debasement

Here’s what the precious metals crowd gets wrong, and what the bond market has been screaming for anyone willing to listen.

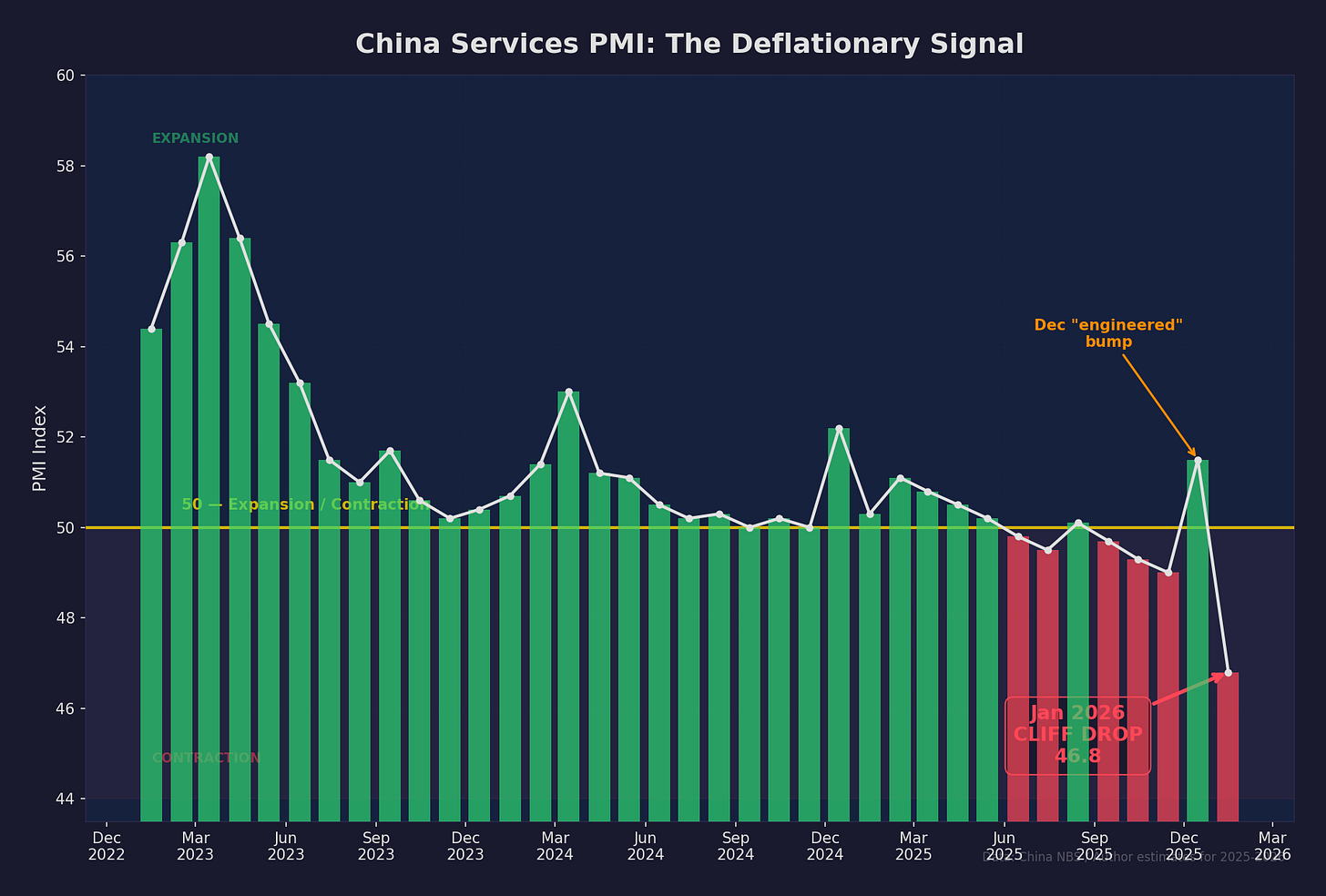

China’s non-manufacturing PMI just fell off a cliff again in January — right back into crashy, deflationary territory after a December bump that was obviously engineered to hit annual growth targets. The PBOC knows there’s no inflation. Chinese government bonds sit at ultra-low yields despite epic bond issuance, which tells you one thing: massive, sustained demand for safe havens.

Sound familiar? It’s the same fundamental impulse driving gold buying. Not dollar debasement — deflationary risk. Economic uncertainty. The search for anything that isn’t Chinese equities, which have become their own speculative casino.

US Treasuries tell the same story from a different angle. The yield curve has been remarkably stable while bull steepening since summer — the kind of signal that says “the economy is slowing and the Fed still hasn’t figured it out.”

Gold and silver, at their fundamental level, belong in the same bucket as bonds. Safe havens against economic deterioration. That’s the real story. Everything else — the dollar debasement narrative, the Reddit-fueled squeeze, the momentum chasers — was noise layered on top of a legitimate signal.

Short-Run Pain, Long-Run Gain

The fundamentals haven’t changed. The deflationary forces that pushed gold above $5,000 are still there. The supply constraints on silver are real. Chinese demand for non-equity safe havens isn’t going away.

But markets overshoot. They overshoot on the way up, and then they overshoot on the way down. Silver going from $79 to $117 in thirteen days was the upside overshoot. What we’re living through now is the correction — and corrections in commodities that went parabolic are brutal, fast, and deeply uncomfortable for anyone who bought the narrative instead of the fundamentals.

The people who got in early on real fundamentals? They’ll be fine. They might be underwater for a few weeks or months, but the thesis holds.

The people who bought silver at $110 because a guy on YouTube told them the dollar was dying?

They just learned an expensive lesson about the difference between a thesis and a trade.

Source: Eurodollar University — Silver Crash Analysis (19 min)

The trends in gold and silver are very long and the short term always looks scary, like last week. Silver broke through a 50 year base top of $50. The bull markets in silver and gold are far from over. Instead of thinking days and weeks with these things, months and years need to be the focus.

Commodities are a different animal than stocks and bonds. Silver is a very well demanded metal for use in various ways. What you hear from China cannot be trusted...in either direction. We had Wuhan after all and that was a complete lie.

I have followed the silver market for years and you bring up some good points that many of the silver and metals writers don't necessarily show, linking them today @https://nothingnewunderthesun2016.com/