The Global Economy is Very, Very Unwell

If you look at the S&P 500 or the Nasdaq over the past few months, you might believe we are in a booming economy, resilient against all odds. But if you look literally anywhere else—at the labor market, the shadow banking system, or the global trade data—a starkly different reality emerges.

We are currently witnessing a global synchronized downturn. The “soft landing” narrative that Powell tried to sell everyone is being dismantled not by models, but by hard data. We have transitioned from an economy that “forgot how to grow” into one that is beginning to remember how to contract. (h/t as ever to our friends over at Eurodollar University)

We have moved from a regime of no hiring/no firing to a dangerous new phase: no hiring and some firing.

Here is the evidence no one in the mainstream wants to admit.

1. The Labor Market Has Broken

For months, the narrative was that the labor market was cooling but solid. The data now confirms that “solid” was a mirage. We are seeing a rapid acceleration in distress that historically only happens at the onset of recessions.

The Layoff Surge: Challenger, Gray & Christmas reported that October 2025 saw 153,074 job cuts. That is up 175% year-over-year and is the worst October since 2003.

Corporate Capitulation: It isn’t just small businesses. Amazon is cutting 14,000 corporate jobs (with leaks suggesting up to 30,000). Verizon is preparing to slash 15% of its workforce. UPS has cut 48,000 jobs since last year.

The Hiring Freeze: The ISM Services Backlog Index dropped to 40.8, the lowest since 2009. Companies have hoarded labor hoping for a rebound; that rebound never came, and now there is no work for those employees to do.

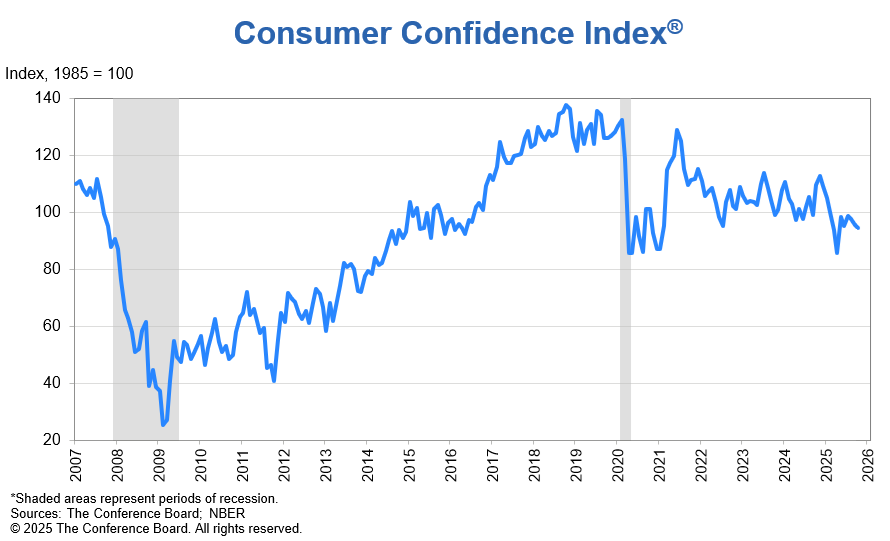

Consumers know what’s coming. In the November University of Michigan survey, 71% of respondents said they expect unemployment to rise over the next year. That is the second-highest reading on record—only May 1980 was higher.

2. The “Affordability” Crisis (It’s Not Just Inflation)

Corporate America is confirming what households have felt for two years: the consumer is tapped out. This isn’t just about inflation; it is about impoverishment. Incomes never caught up to the price shocks of the last few years, and volume is now collapsing. You can thank Covid stimulus for this mess.

The Food Service Bellwether: Wendy’s is closing nearly 300 US locations due to an “oversupply” of restaurants relative to demand. McDonald’s reported a double-digit decline in traffic from lower-income consumers. Chipotle’s stock plummeted after its CEO admitted to a “massive pullback” from its core Gen Z and Millennial audience.

Spending Strike: The Conference Board’s October data shows consumers plan to spend 12% less on non-gift holiday items and 3.9% less on gifts compared to last year—and those are nominal figures. Adjusted for inflation, the volume collapse is severe.

Retail Reality: CarMax expects unit sales to drop 8–12%. Target is cutting corporate staff. Cardboard box shipments—a decent proxy for economic activity—fell to their lowest Q3 levels since 2015.

3. The “Cockroaches” in Shadow Banking

While the real economy slows, the credit system is cracking. Specifically, the “Non-Depository Financial Institutions” (NDFIs)—or shadow banks—are facing a reckoning. We are seeing a systemic repricing of assets from 100 to 0 overnight.

The Fraud Factor: Lenders to Broadband Telecom and BridgeVoice have accused the firms of using $500 million in fake invoices as collateral.

Subprime Contagion: Primal Lend Capital, a subprime auto factor, filed for bankruptcy. Renovo Home Partners saw its debt written down by BlackRock from par (100) to zero in a matter of weeks.

Delinquency Spikes: The cracks are widening. Subprime auto borrowers who are 60+ days delinquent hit 6.65% in October, the highest rate since 1994. Credit card serious delinquencies are at their highest since 2011.

This creates a credit crunch from the inside out. As “cockroaches” are revealed, lenders stop trusting collateral, liquidity dries up, and the cost of funding soars for everyone.

4. The Deflationary Epicenter: China

This downturn is globally synchronized. China is currently acting as a massive deflationary anchor for the world economy.

The Crash: The value of new home sales in China collapsed 41.9% year-over-year in October.

Investment Strike: Fixed Asset Investment is estimated to have dropped over 11% in October alone.

Deflation: China’s GDP deflator has fallen for 10 consecutive quarters.

This weakness is spilling over into currencies. The South Korean Won has fallen to its lowest level since April, and the Indian Rupee has crashed to record lows, forcing central banks to intervene and drain internal liquidity to defend their currencies against a surging Eurodollar.

5. The Fed’s Hand is Forced

Finally, the plumbing of the monetary system is screaming for help. Despite the Federal Reserve’s claims of “ample reserves,” the system is exhibiting acute illiquidity.

Repo Stress: The SOFR (Secured Overnight Financing Rate) spiked to 4.30% the other day, trading significantly above the Fed Funds upper limit.

Dash for Cash: Usage of the Fed’s Standing Repo Facility spiked to $8.4 billion on a non-quarter-end day, the highest since 2020. This signals that dealers cannot find cash in the private market.

The economy is becoming more certain, not less.

We are facing a labor market rollover, a credit crunch in the shadows, and a consumer that has stopped spending.

The markets may be ignoring this for now, but they cannot ignore it forever.

“The Corporate Confessionals: What CEOs Are Actually Saying.”

The Consumer “Strike” (Retail & Food Service)

Wendy’s: The fast-food chain is closing roughly 300 US locations, citing an “oversupply” of restaurants relative to demand. Management noted they are fighting for a share of “contracting traffic.”

McDonald’s: In an internal memo, the US President of McDonald’s admitted the industry is in a “fight for contracting traffic.” Traffic from lower-income consumers dropped by double digits in Q3, a trend persisting for nearly two years.

Chipotle: Shares plummeted after interim CEO Scott Boatwright admitted to a “massive pullback” from their core audience (Gen Z and Millennials), citing their inability to afford the product due to unemployment and paycheck shrinkage.

Kraft Heinz: The CEO didn’t mince words, stating: “We have now one of the worst consumer sentiments we have seen in decades as we go into the holiday season.” Sales volumes fell 3.8% in North America as customers rejected price increases.

Target: In a major restructuring, the retailer is cutting 2,000 corporate roles (8% of headquarters staff). Unlike last year, they refused to publicly commit to a specific number of seasonal hires (last year was 100k), signaling a grim expectation for holiday volume.

CarMax: The used car giant expects unit sales to crash 8% to 12% this quarter. They noted significant depreciation in their inventory values because buyers simply aren’t showing up.

The Supply Chain & Industrial Slowdown

UPS: “Brown” has reduced its workforce by 48,000 employees since last year (34,000 union/warehouse jobs and 14,000 management), signaling that package volume isn’t recovering.

Smurfit Westrock: The paper and packaging giant reported an 8.7% drop in North American box volumes.

International Paper: CEO Andy Silvernail warned that “trade uncertainty” and “soft consumer sentiment” are weighing on demand, reversing their earlier expectations for annual gains.

Phoenix Capital: The president of this freight factoring firm noted that shippers are unilaterally extending payment terms from net-30 days to net-75, 90, or even 120 days, a classic sign of cash flow distress in the supply chain.

The Corporate Labor Purge

Amazon: While the official announcement cited 14,000 corporate job cuts, leaked internal reports suggest the number could be as high as 30,000. This is a reversal from the “hiring freeze” mode of 2022/23 into active headcount reduction.

Verizon: Reports indicate the telecom giant is preparing to cut between 10,000 and 15,000 jobs (roughly 15% of its workforce) right before the Thanksgiving holiday.

Dallas Fed Survey Respondent: One service provider in Texas summed up the macro environment bluntly: “Business [has] felt recessionary for over a year.”

The Credit “Cockroaches” (Shadow Banking)

Renovo Home Partners: A home renovation company backed by private equity. BlackRock and Apollo were carrying this debt at 100 cents on the dollar; weeks later, after a sudden bankruptcy filing, they marked it to zero.

Primal Lend Capital: A subprime auto factoring firm that filed for bankruptcy after missing interest payments on its bonds.

Broadband Telecom & BridgeVoice: These telecom firms (and their financing affiliates) were forced into bankruptcy after lenders alleged they had fabricated $500 million in invoices to use as fake collateral.

First Brands: The collapse of this auto parts company triggered liquidations at hedge funds, including those managed by UBS, and forced write-downs at regional banks like Western Alliance.

I knew something was up. In the mature inner suburb of Toronto where I have lived for the past 20 years, there are mostly post WW2 single family, modest but desirable detached homes on generous lots with trees and quiet streets, close to public transit, schools, daycare, shopping, government services, parks, community center, library etc. The Canadian Dream existed for real here, especially for immigrants, since 1955. This area was affordable and stable in terms of real estate development, for decades. So there was a flurry of excitement from 2019-2022 as real estate values skyrocketed and older bungalows were snapped up to be replaced by luxurious monster homes. Except that as early as 2022, some of these projects began to stall, and then work stopped altogether. On almost every street around me there are now unfinished monster homes and derelict properties. No investors, no buyers despite attractive deals and lower mortgage rates. Bungalows that sold for a million within days in 2019 are now sitting on the market for months at $750,000. These are not good signs.

Reminds one of initial levitation of MBS and CDO prices as the economy started to fall apart in 2008, except more extreme this time (extend and pretend). Economic reality caught up then and will now of course. With stress building in financial institution repo markets reality may strike soon.