I’m guessing these numbers will start demonstrating themselves in the core stats of unemployment. As we pointed out — these could seriously impact the last 60 days of the election.

This is your daily reminder that the stock market is NOT the economy. The services and manufacturing industries are not doing daily reminder that the stock market is NOT the economy. The services and manufacturing industries are not well.

Here's a quick rundown of the newly released services and manufacturing surveys.

ISM Non-Manufacturing Index (services sector):

June 2024: 48.8, a shocking low, consistent with a recession signal.

July 2024: 53.8, an outlier, likely due to seasonal factors.

August 2024: Expected to be below 52.

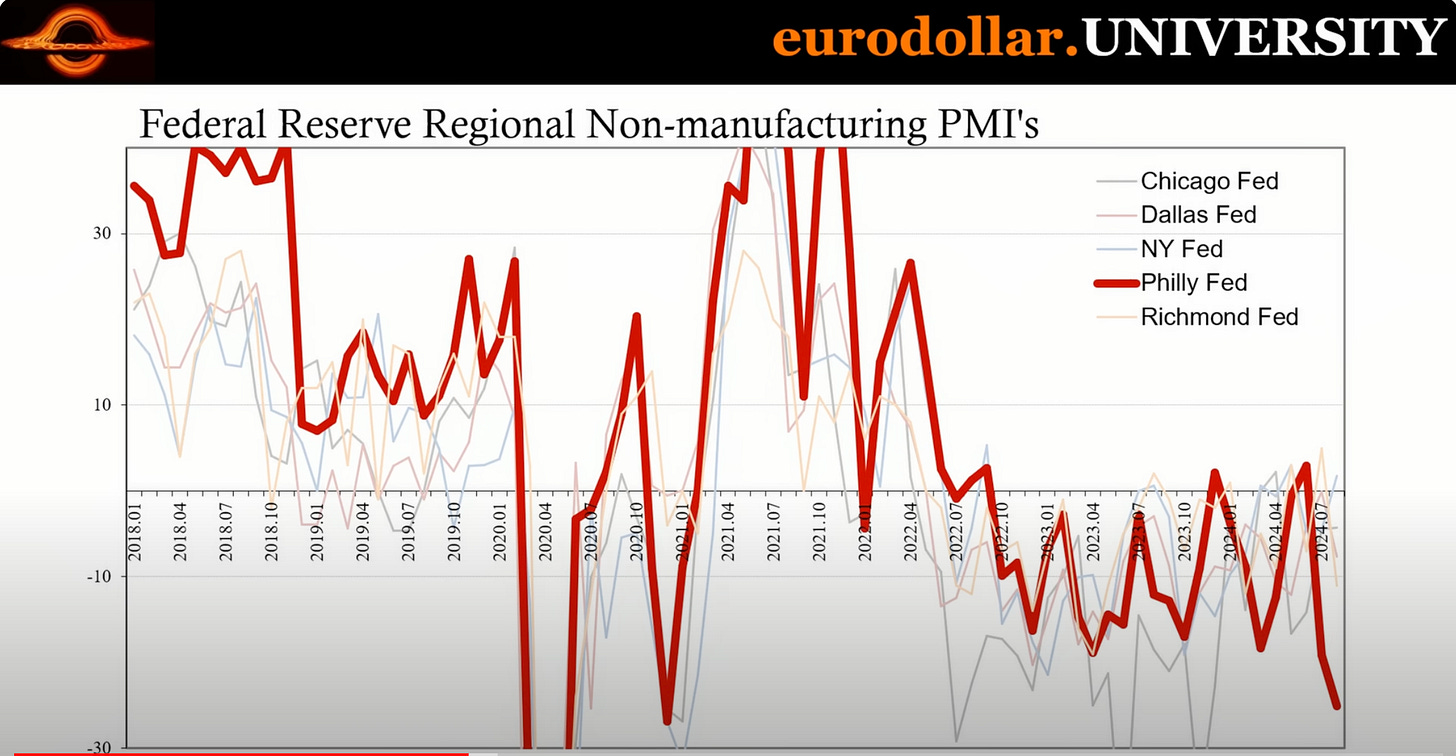

Regional Fed Surveys:

Average of the five regional Fed surveys for August 2024: -9.25, down sharply from July 2024.

Philadelphia Fed Non-Manufacturing Business Outlook Survey:

August 2024: -25.1, the lowest since March-May 2020, second worst in the series outside the pandemic.

Full-time employment index: -4.9, second consecutive negative reading, lowest since May 2020.

Richmond Fed Fifth District Survey of Service Sector Activity:

Revenues index: -1, down from +5 in July 2024.

Demand index: -3, down from +1 in July 2024.

Number of employees index: -4, fifth consecutive month of decline.

Dallas Fed Texas Service Sector Outlook Survey:

Business activity index: -7.7, down from -0.1 in July 2024.

New York Fed Services Survey:

August 2024: +1.8, up from -4.5 in July 2024, the best of the bunch, but still not strong.

Chicago Fed Services Survey:

August 2024: -4.26, slightly improved from July, but still weak.

Manufacturing Sector. ISM Manufacturing Index:

July 2024: 46.8, deeply negative.

August 2024: Expected to be below 50, likely due to the ongoing downward trend.

Regional Fed Surveys:

Average of the five regional Fed manufacturing surveys for August 2024: -8.68, slightly worse than July 2024.

Philadelphia Fed Manufacturing Survey:

August 2024: Plunged to a low comparable to April-May 2020 or September 2008.

Richmond Fed Fifth District Manufacturing Survey:

August 2024: -19, down from -17 in July 2024.

Dallas Fed Manufacturing Survey:

August 2024: -9.7, the least negative since January 2023.

New York Fed Empire Manufacturing Survey:

August 2024: Slightly better, but still negative.

Kansas City Fed Manufacturing Survey:

August 2024: -3, an improvement from -3 in July.

Key Takeaways:

Both the services and manufacturing sectors are showing signs of weakness, with multiple surveys indicating contraction and declining employment.

The August 2024 data for the services sector is particularly alarming, with several surveys showing significant declines, including the Philadelphia Fed survey, which hit its lowest level since the pandemic.

The regional Fed surveys and the ISM data generally align, with S&P Global's data being an outlier, likely due to seasonal factors.

The manufacturing sector is also exhibiting weakness, with the average of the five regional Fed manufacturing surveys for August showing a decline from July.

The surveys highlight the potential for a broader economic slowdown, particularly given the widespread negative signals about employment in both the services and manufacturing sectors.

8/20/24: American private sector business is in a recession; note the 1 MILLION jobs reduction this month. Another Bidenesque “miscalculation” erroneously portraying the economy. American deep state employment is in overdrive & our bureaucratic bimbos are in full denial of inflation costs re: food, rent, dollar de-valuation, military readiness, or crime stats.

Sure, the elections could be impacted as with more people out of work, that means the fascist dems can hire (pay them) more stooges to wreck the election. But what won't change is the effect the election will have. Not enough people are fighting or even care about digital technocratic tyranny. Their cell phones are all that matters. And in that, they are now trapped and compromised.